Try bikeleasing calculator now...

... and save up to 40%!

Monthly costs

€ 63,52

You save

€ 2.001

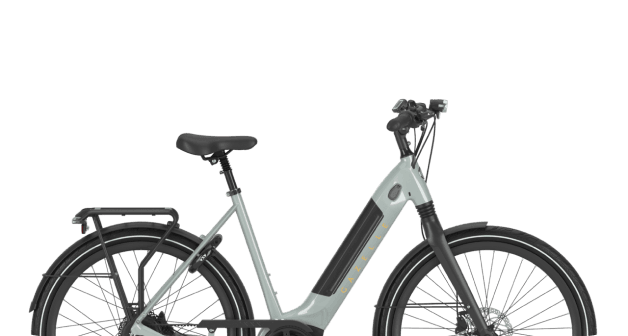

E-bike & bicycle leasing: Our bike leasing calculator calculates your savings

Please note that the lease payment shown in the lease calculator is a non-binding calculation example. This calculation in the lease calculator is indicative and may differ from the final amount payable in some cases. Lease a Bike does not guarantee any future changes to the tax system. Please note that the expected purchase price at the end of the lease term, as indicated in the bicycle leasing calculator, is a non-binding guideline.

We are the leasing partner for bicycle and e-bike leasing in Austria, which is completely cost-neutral for employers and offers employees a huge advantage!

✓ No service fees

✓ No legal transaction fees

✓ No surprises

Please note: You can only benefit fully from the stated tax savings if your salary is at least the calculated total rate above the collective agreement. You can find the conversion rate in the calculation overview.

Savings

Lease a bike & save CO₂!

Lease a bike and do something good for the environment. Use our CO₂ calculator to estimate how much CO₂ emissions you can save by leasing a bike.